Decoding HashKey's Prospectus: The True Financials Behind Hong Kong's First Crypto Asset Stock

TechFlow Selected TechFlow Selected

Decoding HashKey's Prospectus: The True Financials Behind Hong Kong's First Crypto Asset Stock

This document answers "who HashKey is," but the question of "what it's worth" will have to wait for the market to answer.

By David, TechFlow

HashKey is going public.

On December 1, Hong Kong’s largest licensed crypto exchange platform passed the Hong Kong Stock Exchange (HKEX) hearing, officially entering its IPO sprint phase. JPMorgan, Cathay Capital & Haitong, and Guotai Junan International are serving as joint sponsors.

The so-called "hearing" is a critical milestone in the HKEX listing process. It involves the listing committee reviewing the company's application materials, and passing it means that major regulatory hurdles have been cleared. The next steps are pricing, roadshows, and listing.

From an industry perspective, this will be the second crypto-related enterprise to list on the Hong Kong stock exchange after OSL. However, their positioning differs:

OSL focuses more on institutional custody and brokerage services, whereas HashKey started as a retail exchange with broader business lines and is more directly exposed to the cyclical fluctuations of the crypto market.

The prospectus (post-hearing document set) is the most solid source for understanding a company. This article breaks down key information from this document across several dimensions: revenue structure, financial performance, user data, and equity structure.

Business Overview: More Than Just an Exchange

Many people perceive HashKey simply as a "licensed Hong Kong exchange," but the prospectus reveals a far more complex picture.

HashKey defines itself as a "comprehensive digital asset company," with its business structured around three core pillars: transaction facilitation services, on-chain services, and asset management services.

Clearly, HashKey aims to build a full-cycle digital asset ecosystem covering "trading–custody–staking–asset management."

Transaction facilitation is the foundation. This includes the familiar spot exchange, along with OTC services for large trades.

As of September 2025, the platform had facilitated cumulative spot trading volume of HK$1.3 trillion, with platform assets reaching HK$19.9 billion. Based on 2024 trading volume, HashKey is Hong Kong’s largest licensed platform, holding over 75% market share, and also Asia’s largest regional onshore platform.

On-chain services provide differentiation. This segment consists of three parts: staking services, tokenization services, and its proprietary HashKey Chain (an L2).

Staking has achieved the most significant scale. As of September 2025, staked assets reached HK$29 billion, making HashKey the largest staking service provider in Asia and eighth-largest globally.

The tokenization business focuses on bringing real-world assets (RWA) onto the blockchain, currently centered on financial assets, with future plans to expand into precious metals, computing power, and green energy.

Asset management extends institutionalization. HashKey manages client assets through two flagship funds. As of September 2025, total AUM since inception was HK$7.8 billion, completing over 400 investments. This business includes early-stage venture investments as well as active and passive strategies in secondary markets.

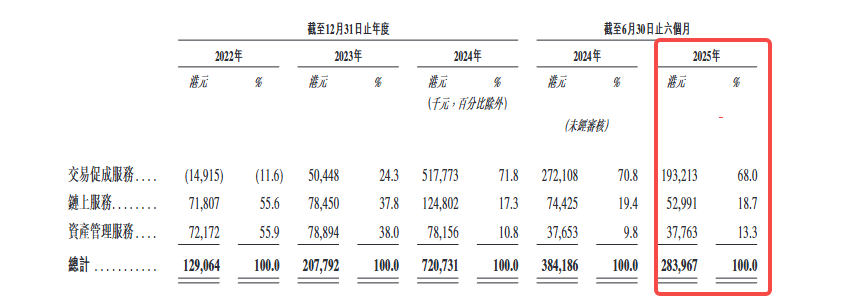

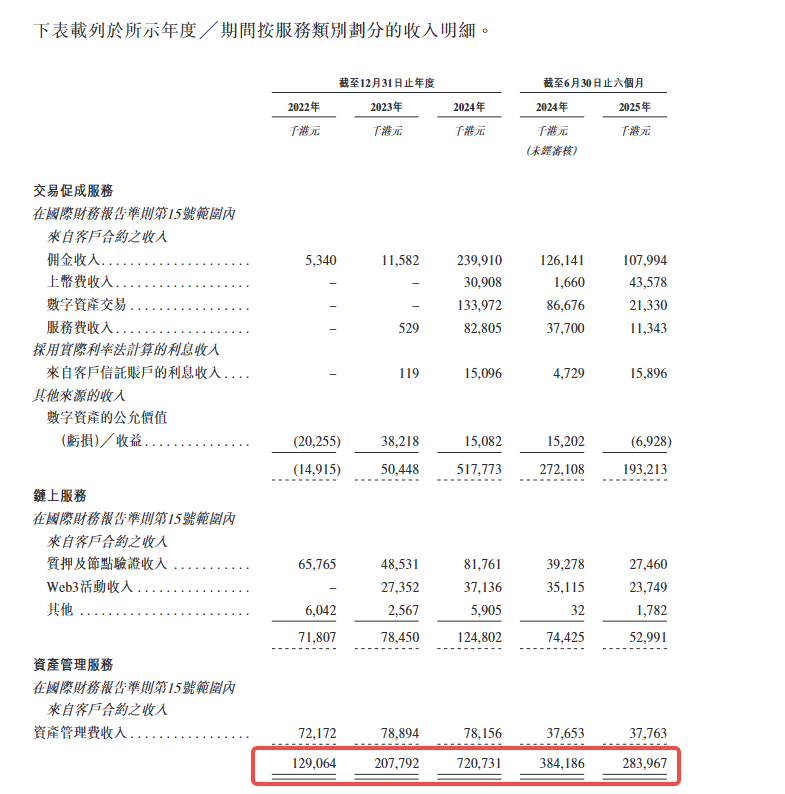

In terms of revenue structure, in the first half of 2025, transaction facilitation contributed 68% of revenue, on-chain services accounted for 18.7%, and asset management made up 13.3%. Trading remains central, but the shares of on-chain and asset management are gradually increasing.

Revenue Structure: Nearly 70% from Trading, Volatility Is Inherent

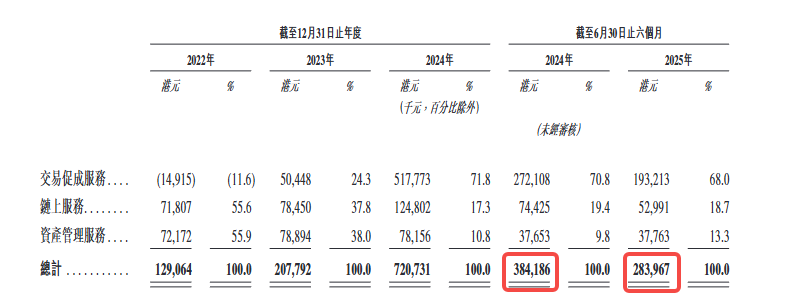

HashKey's revenue growth curve is extremely steep. Revenue was HK$129 million in 2022, increased to HK$208 million in 2023 (up 61%), and surged to HK$721 million in 2024 (up 247%).

This is a classic bull-market beneficiary trajectory.

However, growth halted abruptly in the first half of 2025. Revenue for this period was HK$284 million, down 26% year-on-year. This turning point warrants deeper analysis.

We can break down the financial performance of HashKey's different businesses as follows:

-

Transaction business dominates revenue.

In the first half of 2025, transaction facilitation services contributed 68% of revenue, derived specifically from trading commissions, OTC spreads, and changes in fair value of digital assets. Commission fees mainly come from USDT, BTC, and fiat currency trading pairs.

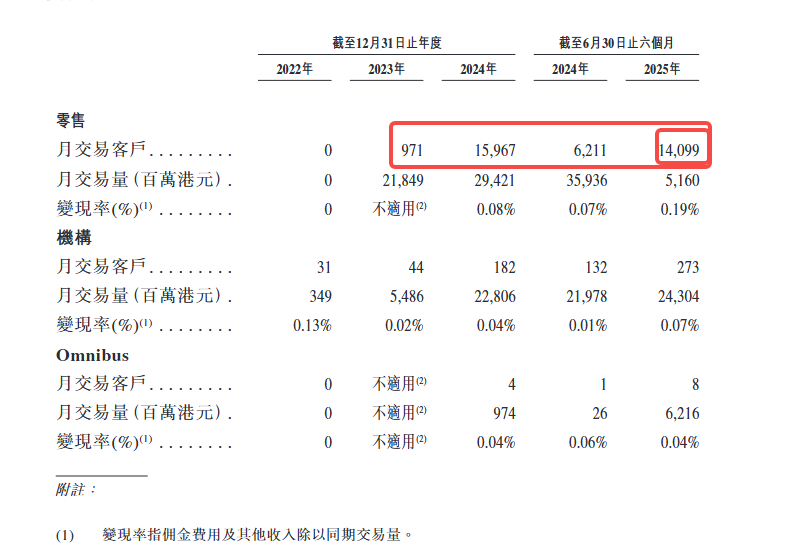

The prospectus discloses two key metrics: monthly transacting customers and monetization rate.

Looking at monthly transacting customers, there were around 16,000 retail traders per month in 2024; by the first half of 2025, this number dropped to around 14,000; while not high in absolute terms, institutional clients, though fewer in number than retail, contributed significantly more trading volume during the first half of 2025.

The other metric is monetization rate—commission income divided by trading volume. Institutional clients have a rate of approximately 0.07%, retail clients about 0.19%, and Omnibus clients (those accessing via partners) around 0.04%.

This reflects HashKey’s pricing power and customer composition. Retail customers trade smaller amounts per transaction but pay higher fees; institutions trade larger volumes but negotiate much lower rates.

-

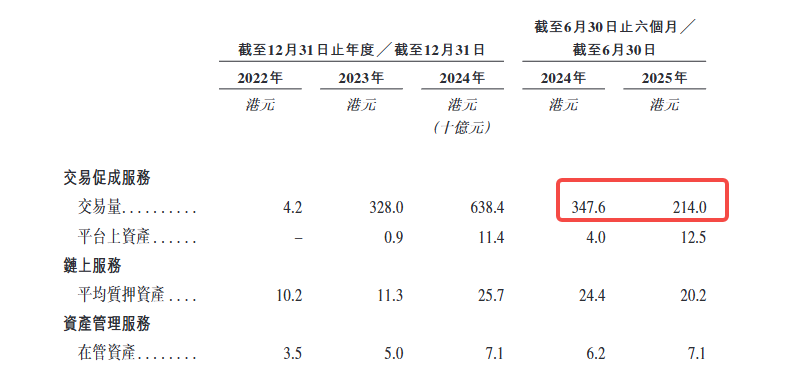

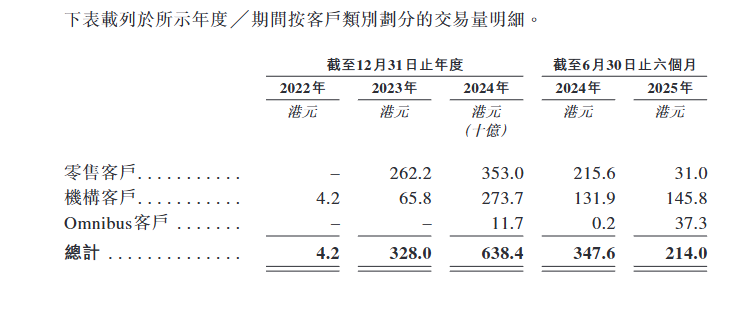

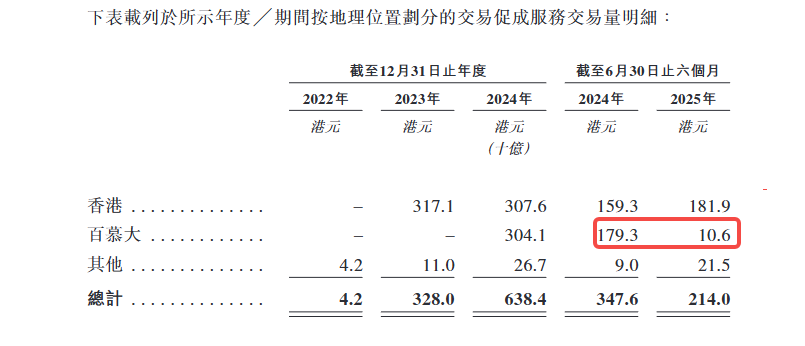

Trading volume volatility directly impacts revenue.

In the first half of 2024, HashKey’s trading volume reached HK$347.6 billion, but declined sharply to HK$214 billion in the first half of 2025.

This drop stems from two factors: overall market weakness and HashKey’s deliberate contraction of operations in Bermuda due to lack of fiat on/off-ramps, shifting strategic focus back to Hong Kong.

-

The proportion of on-chain services and asset management is rising.

In the first half of 2025, on-chain services contributed 18.7% of revenue, and asset management contributed 13.3%. On-chain service revenue primarily comes from staking rewards and tokenization fees, while asset management earns from management fees and performance incentives.

These segments have relatively high gross margins, but their scale remains insufficient to offset volatility in trading revenue.

The revenue structure highlights a core contradiction: HashKey’s growth is highly dependent on trading volume, which in turn depends heavily on market conditions. This is the fate of all exchanges, but for a company preparing to go public, such dependence implies weak earnings predictability.

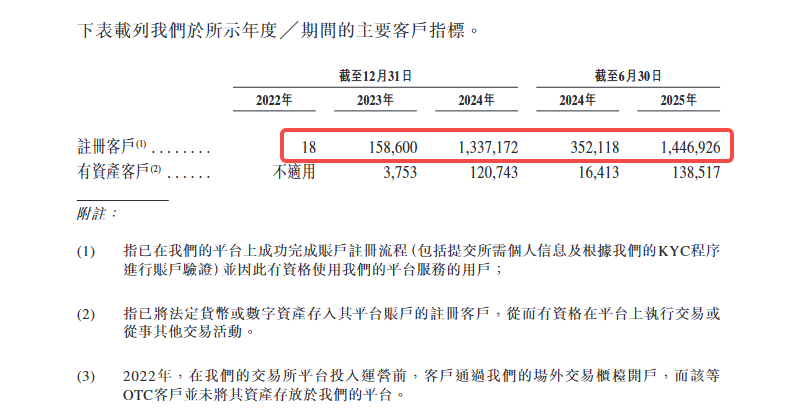

User Data: From 18 to 1.44 Million Registered Users in Three Years

HashKey’s user growth shows clear late-stage acceleration.

At the end of 2022, the platform had only 18 registered users; by the end of 2023, this rose to 158,600; by the end of 2024, it jumped to 1.3372 million; and by June 2025, it further increased to 1.4469 million. In just two and a half years, user base grew 80,000-fold.

But registered users are only part of the story. What truly matters is “clients with assets”—users who hold digital assets or fiat on the platform.

By the end of 2023, clients with assets numbered only 3,753; by the end of 2024, this increased to 120,700; and by June 2025, reached 138,500. The conversion rate (clients with assets / registered users) improved from 2.4% at the end of 2023 to 9.6% in June 2025, indicating many new registrants completed KYC and remained active.

The prospectus discloses a key figure: retention rate among clients with assets is as high as 99.9%.

This number looks impressive, but note that it refers to retention of “clients with assets,” not active trading clients. In other words, users keep their assets on the platform but may not trade frequently.

Equally important is the shift in customer composition.

HashKey categorizes its clients into three types: institutional clients, retail clients, and Omnibus clients (those accessing via partners).

In terms of trading volume share, institutional clients have seen continuous growth: accounting for 62% in the second half of 2024, rising further to 68% in the first half of 2025. Meanwhile, retail trading volume plummeted in the first half of 2025—from HK$215.6 billion down to HK$31 billion.

This shift reflects both cooling market sentiment and HashKey’s intentional pivot toward institutional clients.

Omnibus clients represent another interesting growth vector. In the second half of 2024, their trading volume was only HK$200 million, but surged to HK$37.3 billion in the first half of 2025. This indicates HashKey is rapidly expanding via B2B2C partnerships, collaborating with other platforms or institutions to indirectly serve end-users.

Geographically, Hong Kong continues steady growth, while Bermuda saw sharp contraction in the first half of 2025 due to lack of fiat on/off-ramps leading to declining user activity—this is precisely why HashKey strategically downsized its Bermuda operations.

In summary, HashKey is transitioning from retail-driven to institution-driven, and from direct customer acquisition to partner-led growth.

This is a typical path for compliant exchanges, but it also suggests retail engagement and stickiness still need validation.

Financial Reality: Losses Narrowing, But Still Not Profitable

HashKey’s financial situation is improving, but it has not yet reached profitability.

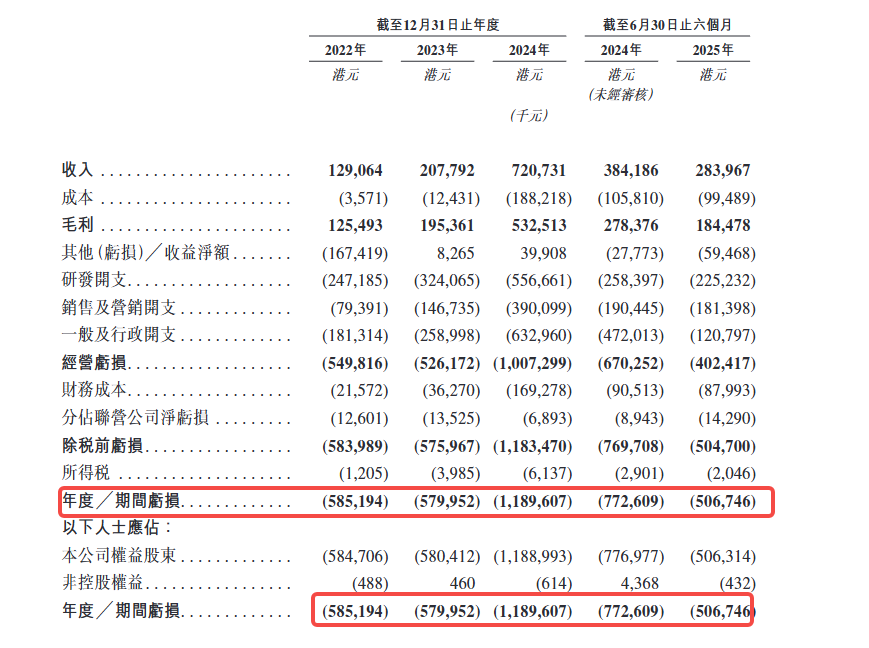

According to the consolidated income statement, HashKey’s losses show a distinct three-phase pattern: HK$585 million loss in 2022, nearly flat at HK$580 million in 2023, then nearly doubling to HK$1.19 billion in 2024.

A turnaround emerged in the first half of 2025, with a loss of HK$506.3 million—down 35% compared to HK$770 million in the same period of 2024.

The prospectus states that the massive 2024 loss stemmed from three main factors: first, operating loss widened from HK$526.2 million to HK$1.0073 billion, an increase of HK$480 million; second, financial costs soared from HK$36.27 million to HK$169.3 million, adding HK$130 million; third, "net other losses" swung from a gain of HK$8.265 million in 2023 to a loss of HK$399.1 million—a difference of HK$400 million. This last item was primarily due to "changes in fair value of digital assets." During periods of market volatility, the book value of market-making and proprietary-held digital assets sharply declined.

Revenue dropped 26%, with transaction business being the main drag

Total revenue for 2024 was HK$720.7 million, 3.5 times that of 2023. However, revenue in the first half of 2025 was HK$284.0 million, down 26% from HK$384.2 million in the same period of 2024. Almost all of this decline came from the transaction business: commission income fell from HK$126.1 million to HK$108.0 million, and digital asset trading income plunged from HK$86.68 million to HK$21.33 million—a 75% drop. The only bright spot was listing fees, which surged from HK$1.66 million to HK$43.58 million.

The prospectus attributes this to slowing market trading activity and the deliberate scaling back of Bermuda operations.

Gross margin declined from 72.5% to 65.0%

Gross margin was 72.5% in the first half of 2024, dropping to 65.0% in the first half of 2025. This is because profitability in digital asset trading and market-making is highly sensitive to market conditions: during downturns, trading volume shrinks and held assets incur book losses, squeezing margins on both fronts.

Equity Structure: Who Gets the Pie?

In HashKey’s equity structure, three key questions arise: who controls the company? Who benefits from the listing? And who will ultimately receive equity from the redeemable liabilities?

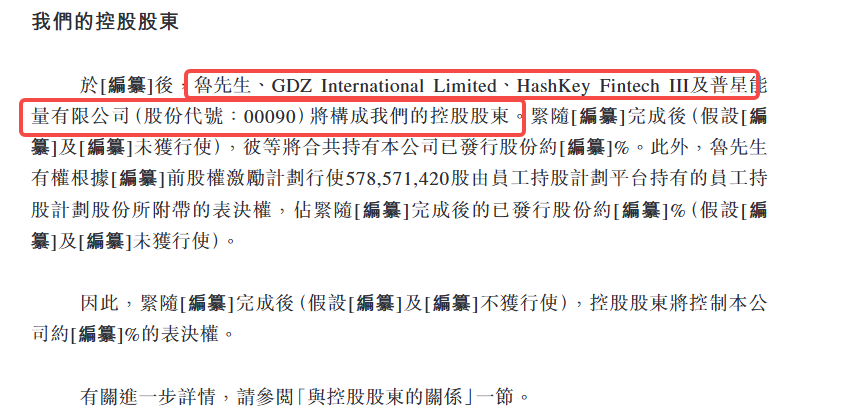

The prospectus discloses that four parties constitute the controlling shareholders of HashKey:

-

Lu Weiding: Non-executive director, actual controller of Wanxiang Group

-

GDZ International Limited: Affiliated entity

-

HashKey Fintech III: Subsidiary fund of the company

-

Puxing Energy Limited (stock code: 00090)

Since the prospectus has not yet been finalized, the exact shareholding percentages of these four parties are not disclosed and are marked in the document as "[to be compiled]".

Two names are essential in HashKey’s power structure:

Xiao Feng: Executive Director, Chairman, and CEO. Referred to as Dr. Xiao in the prospectus. He is an early advocate of blockchain in China and formerly served as General Manager of Boshi Fund. He founded the Wanxiang Blockchain Lab in 2015. Within HashKey’s narrative, Xiao Feng is the spiritual leader and strategic architect.

Lu Weiding: Non-executive director, referred to as Mr. Lu in the prospectus. Chairman of Wanxiang Group. One of China’s largest auto parts suppliers and a major shareholder of HashKey. Lu Weiding holds substantial voting rights through direct ownership and control of employee shareholding platform voting rights.

Lu Weiding also holds a special right: he has the authority to exercise voting rights attached to 578.6 million shares held in the employee shareholding plan platform, under the pre-IPO equity incentive scheme. The prospectus notes that the percentage of post-listing issued shares represented by these shares will be finalized later.

In other words, the controlling shareholders not only hold shares directly but also indirectly control a large portion of voting rights through employee shareholding platforms. The prospectus explicitly states:

Immediately following [to be compiled] (assuming [to be compiled] and [to be compiled] are not exercised), the controlling shareholders will hold approximately [to be compiled]% of the company’s voting rights.

This is a highly concentrated ownership structure, implying that post-listing corporate governance will be heavily influenced by the controlling shareholders’ will.

The prospectus also discloses a noteworthy detail:

During the historical record period, HashKey Fintech III, GDZ International Limited, and HashKey Fintech II were each among the company’s top five clients and were affiliated with the controlling shareholders.

This indicates that HashKey’s early revenue was highly reliant on related-party transactions. Although this proportion is decreasing, it still raises a question: how much of the company’s commercial capability is truly independent?

A similar situation exists on the supplier side. The prospectus reveals that Wanxiang Blockchain entities were among the top five suppliers in 2022, 2023, 2024, and the six months ended June 30, 2025, and are affiliated with one of the company’s shareholders.

In summary, the primary beneficiaries of HashKey’s listing include:

-

Controlling shareholders: Hold the highest share percentage (exact figure pending final disclosure) and control additional voting rights via employee shareholding platforms

-

Pre-IPO investors: Redeemable liabilities will convert to equity, making them significant shareholders; the listing serves as a key exit window

-

Employees: Hold 578.6 million shares through the employee shareholding plan

-

Management: The prospectus discloses that in 2024, the company recognized HK$566.2 million in share-based compensation expenses—an unusually large one-time grant.

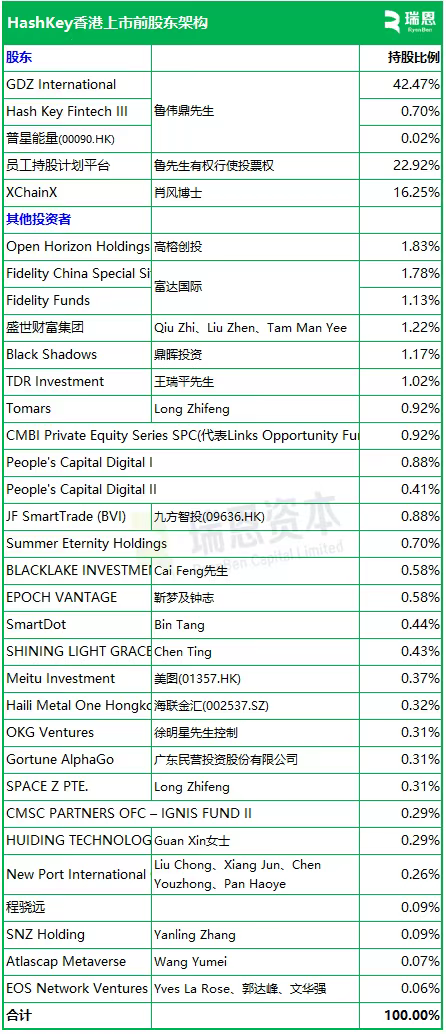

Beyond the prospectus, Ryan Capital has disclosed a more detailed breakdown of HashKey’s shareholder stakes, which can serve as cross-reference.

This table confirms earlier analysis: ownership is highly concentrated. GDZ International holds 42.47%, combined with the employee shareholding platform (22.92%, voting rights exercised by Lu Weiding) and XChainX (16.25%, owned by Xiao Feng), together exceeding 80%. The actual free float after listing will be very small.

Several categories of stakeholders stand out in the shareholder list:

First, traditional asset managers. Fidelity invested through two funds totaling approximately 2.9%, which is uncommon among crypto company shareholders, indicating that HashKey’s “compliance narrative” appeals to traditional institutions.

Second, Hong Kong and A-share listed companies. Meitu (01357.HK), Ninepoint Intelligence Investment (09636.HK), and Hailian Jin Hui (002537.SZ) are all present. For these firms, investing in HashKey offers exposure to crypto assets.

Third, top-tier RMB funds. Gaorong Capital and CDH Investments were early backers. The IPO represents their primary exit route.

Notably, OKX and EOS also participated in earlier rounds.

What to Watch Next

After clearing the hearing, HashKey enters the pricing and roadshow phase. According to HKEX procedures, the formal offering to listing typically takes two to three weeks. At that time, the price range, cornerstone investor list, and specific allocation of proceeds will be clarified.

Several figures are worth tracking:

First, valuation. Bloomberg previously reported fundraising of up to $500 million, but whether this corresponds to a premium or discount relative to OSL in terms of P/S ratio will only become clear once pricing is set.

Second, cornerstone investor composition. If traditional financial institutions (banks, brokers, asset managers) commit as cornerstones, it signals institutional acceptance of the “regulated crypto asset” narrative; if mainly crypto-native funds or related parties participate, the story differs.

Third, post-listing trading volume and stock performance. OSL experienced volatile share prices and mediocre liquidity after listing. HashKey is larger in scale, but Hong Kong’s ability to price crypto assets remains uncertain.

The prospectus is static; the market is dynamic. This document answers “Who is HashKey?” But the question “What is it worth?” must await the market’s verdict.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News