Is the rise of Bitcoin treasury companies a necessary path beyond the dollar?

TechFlow Selected TechFlow Selected

Is the rise of Bitcoin treasury companies a necessary path beyond the dollar?

One day Bitcoin will surpass the US dollar, and then other things will naturally be priced in it.

Written by: Lyn Alden

Translated by: AididiaoJP, Foresight News

Crypto-punks and traditional institutions have differing but valid perspectives on Bitcoin stocks. Bitcoin must function as a free currency, yet it is entirely reasonable for large amounts of capital to flow into Bitcoin.

Over the past year or so, much of Bitcoin’s price increase has been driven by the rise of corporate Bitcoin treasury strategies.

Although MicroStrategy pioneered this approach back in 2020, other companies were slow to follow. However, after the Financial Accounting Standards Board (FASB) made significant updates in 2023 regarding how Bitcoin is treated on balance sheets, 2024 and 2025 saw a surge in new companies adopting Bitcoin treasury strategies.

This article explores that trend and analyzes its impact on the broader Bitcoin ecosystem. It also discusses topics related to Bitcoin as a medium of exchange versus a store of value.

Why Bitcoin Stocks and Bonds?

Back in August 2024, when this trend was just beginning, I wrote an article titled A New Look at Corporate Treasury Strategy, explaining the utility of Bitcoin as a corporate treasury asset. At that time, only a few companies had adopted this strategy at scale, but since then, more and more new and existing companies have joined in. Early adopters such as MicroStrategy and Metaplanet have seen their stock prices and market valuations rise significantly.

The article explained why companies should consider implementing this strategy. But what about investors? Why is this strategy so attractive to them? From an investor's perspective, why buy Bitcoin stocks instead of buying Bitcoin directly? There are several key reasons.

Bitcoin Stocks, Reason One: Restricted Capital

Globally, trillions of dollars in managed capital face strict investment constraints.

For example, some equity funds can only purchase stocks and cannot invest in bonds, ETFs, commodities, or other assets. Similarly, bond funds may only buy bonds. There are even more specific limitations—some fund managers can only invest in healthcare stocks or non-investment-grade bonds.

Some of these fund managers are bullish on Bitcoin; many even hold Bitcoin personally. Yet they cannot gain direct exposure to Bitcoin through their funds. However, if a company issues a stock with Bitcoin on its balance sheet (a “Bitcoin stock”), or issues convertible bonds for a company holding Bitcoin, they can bypass these restrictions and make purchases. This previously untapped market is now being gradually explored in the U.S., Japan, the U.K., South Korea, and elsewhere.

I've maintained a real-money model portfolio since 2018 so readers can track my holdings.

In early 2020, I strongly recommended Bitcoin as an investment and invested myself. I wanted to add Bitcoin exposure to my model portfolio, but the brokerage account I used for that portfolio could not purchase Bitcoin or Bitcoin-related securities. I couldn’t even buy Grayscale Bitcoin Trust (GBTC), because it traded over-the-counter rather than on a major exchange.

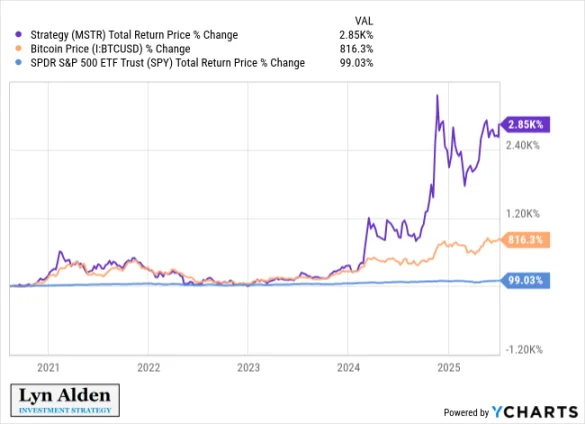

Luckily, MicroStrategy added Bitcoin to its balance sheet in August 2020. The stock trades on Nasdaq, which my model portfolio’s brokerage could access directly. Given the constraints of the portfolio, I was happy to buy MSTR early, and that decision has paid off handsomely over nearly five years:

Later, the brokerage added GBTC and eventually the major spot Bitcoin ETFs. Nonetheless, I continue to hold MSTR in that portfolio.

In short, due to investment restrictions, many funds can only hold stocks or bonds with Bitcoin exposure—not ETFs or similar instruments. Bitcoin treasury companies (“Bitcoin stocks”) provide them with that opportunity.

This does not conflict with Bitcoin as a bearer asset that individuals can self-custody—it complements it.

Bitcoin Stocks, Reason Two: Corporations Have Ideal Leverage

The basic strategy of corporations using Bitcoin as a treasury asset is to hold Bitcoin instead of cash equivalents. However, the first wave of Bitcoin stocks often exhibit extreme conviction in this idea. So rather than simply buying Bitcoin outright, they use leverage to amplify their positions.

Publicly traded companies happen to have better leverage tools than hedge funds and most other capital pools—specifically, the ability to issue corporate bonds.

Hedge funds and certain other entities typically rely on margin loans. They borrow money to buy more assets, but if the asset value drops too far relative to the loan amount, they face margin calls. A margin call may force a hedge fund to sell assets during steep price declines—even if they believe the assets will recover and reach new highs. Being forced to sell high-quality assets at lows is disastrous.

In contrast, corporations can issue bonds, usually with maturities spanning multiple years. If they hold Bitcoin and its price falls, they are not forced to sell simply because of the decline. This makes them more resilient to volatility than entities relying on margin loans. Of course, there are still bearish scenarios that could force corporate liquidation, but these require prolonged bear markets and are thus less likely.

This long-term corporate leverage is generally superior to leveraged ETFs. Because leveraged ETFs cannot use long-term debt and reset leverage daily, volatility tends to erode performance.

What happens to a 2x leveraged ETF if the underlying asset alternates between +10% and -10% each trading day? Over time, the leveraged product deteriorates relative to its index:

In reality, since inception, the 2x leveraged Bitcoin ETF BITU has not meaningfully outperformed Bitcoin, despite Bitcoin's price rising during that period. You might expect the 2x version to significantly outperform, but in practice, it mainly increases volatility without delivering higher returns. Here is a chart of BITU’s performance since inception:

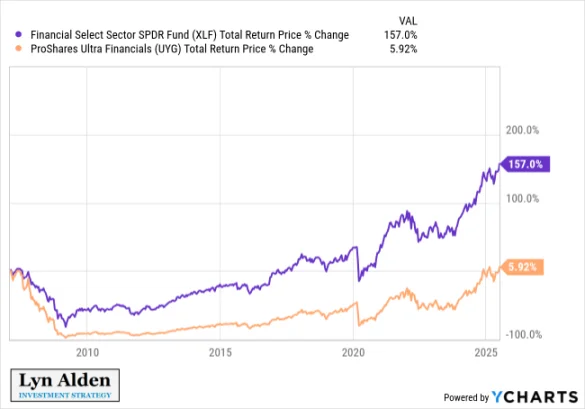

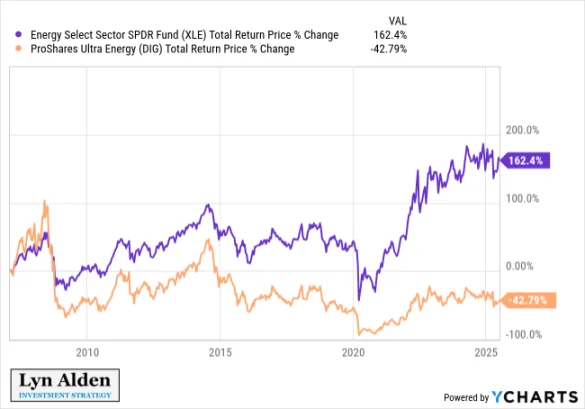

The same pattern appears in the long histories of volatile stocks, such as 2x leveraged ETFs for financial or energy sectors. During volatile periods, they underperform dramatically:

Therefore, unless you’re a short-term trader, intraday leverage usually performs poorly. Volatility is extremely detrimental to leveraged products.

However, attaching long-term debt to an appreciating asset generally avoids this problem. An asset with multi-year debt attached is a highly attractive combination. Thus, Bitcoin treasury companies are appealing securities for high-conviction Bitcoin bulls who want to enhance returns through reasonably safe leverage.

Not everyone should use leverage, but those who choose to naturally want to do so in the most optimized way possible. Now, various Bitcoin treasury companies—with different risk profiles, sizes, industries, and jurisdictions—are emerging to meet real market demand.

Additionally, some securities issued by these companies, such as convertible bonds or preferred shares, can offer exposure to Bitcoin’s price while reducing volatility. Diversified securities allow investors to get the exact type of exposure they need.

What Is the Impact of Bitcoin Treasury Companies on Bitcoin?

Now that we understand why Bitcoin treasury companies exist and the market gap they fill for investors, the next question is: Are they beneficial for the Bitcoin network overall? Does their existence undermine Bitcoin’s value as a free currency?

First, we must clarify the theoretical development path of a decentralized currency if it succeeds. What steps are required, and roughly in what order?

So this section is divided into two parts. Part one analyzes the economics of how a new form of money becomes popular—what a successful path might look like. Part two analyzes whether corporations help or hinder that path.

Part One: What Would Success Look Like?

“What would it look like for a global, digital, sound, open-source, programmable currency to go from zero to widespread circulation?”

Ludwig Wittgenstein once asked a friend, “Tell me, why do people think it is more natural that the sun goes around the Earth than that the Earth rotates?” The friend replied, “Well, obviously because it looks as if the sun goes around the Earth.” Ludwig responded, “And how would it look if the Earth rotated?”

— “Wittgenstein’s Money,” Allen Farrington, 2020

Bitcoin was born in early 2009. Throughout 2009 and 2010, enthusiasts mined, collected, tested, bought, sold, or researched ways to contribute to or improve Bitcoin. They were captivated by its concept.

In 2010, Satoshi Nakamoto himself described on a Bitcoin forum how Bitcoin could gain initial value from scratch:

“As a thought experiment, suppose there is a precious metal as scarce as gold but with the following properties:

-

Dull gray in color

-

Poor electrical conductor

-

Not strong, nor malleable or ductile

-

No practical or decorative uses

And one special, magical property:

-

Can be transmitted via communication channels

If it acquired any value for whatever reason, anyone wanting to transfer wealth over long distances could buy some, transmit it, and the recipient could sell it.”

After gaining initial traction, Bitcoin faced challenges as countless competitors emerged. Numerous altcoins appeared with similar functionality—mainly the ability to be bought, transferred, and sold by recipients. Then in 2014, stablecoins eliminated token volatility by being backed with U.S. dollars.

In fact, the rise of competitors was the main reason I didn’t buy Bitcoin in early 2010. Not because I opposed the concept, but because I believed the industry was speculative and infinitely replicable. In other words, while Bitcoin’s supply is finite, its idea is infinite.

But in late 2010, I noticed something: Bitcoin’s network effects were growing. Like communication protocols, Bitcoin benefits enormously from network effects—the more people use it, the more useful it becomes for others, creating a self-reinforcing cycle. That’s precisely what holding Bitcoin is about. Network effects must keep growing to transcend the niche and crowded phase.

We can divide currencies into two categories:

The first is “contextual currencies”—those that solve specific problems but aren’t widely used otherwise. An asset that can be bought locally, transferred across borders with high slippage (due to capital controls, payment platform bans, etc.), and sold or exchanged by the recipient. It holds value, but success here doesn’t necessarily lead to broader adoption.

The second is “universal currencies”—those widely accepted within a region or industry. Crucially, recipients don’t immediately sell or convert them upon receipt; they hold them as cash balances and may reuse them elsewhere.

For a currency to become universal, spenders must hold it long-term, and recipients must be willing to hold it. If a new universal currency is to emerge, most people will initially see it as an investment—believing its purchasing power may rise—and then be willing to accept it as payment. At that point, they don’t need to be persuaded to accept it—they already recognize the asset’s value.

Bitcoin’s simple and secure design (proof-of-work, fixed supply, limited script complexity, modest node requirements, and founder disappearance leading to decentralization), along with first-mover network effects, give it the best liquidity and security, making many people want to buy and hold it. So far, Bitcoin has achieved massive success as a secure, portable store of value that users can freely spend or exchange.

A secure, liquid, exchangeable, portable store of value sits between contextual and universal currencies. Unlike contextual currencies, people view a universal currency as an asset to hold long-term, not just to sell or convert immediately upon receipt. But unlike a truly universal currency, it isn’t yet widely accepted in most regions because only a minority have taken the time to research it.

This stage takes a long time to complete, due to volatility and the sheer size of existing network effects—since people’s spending and liabilities are denominated in existing currencies.

If a new monetary network with its own independent unit (not pegged as credit on existing currencies, but running parallel to central banks) is to grow from nothing to massive scale, it needs upward volatility. Any appreciating asset with upward volatility attracts speculators, inevitably leading to downward volatility periods. In other words, it looks like this:

During its adoption phase, it’s a flawed form of money in the short term. If you receive Bitcoin and want to pay your rent at month-end, neither you nor your landlord can afford a 20% drop in value within a month. The landlord’s expenses depend on the network effects of existing fiat; she needs to know the rent she receives holds value. And as a tenant, you need assurance that you can pay rent with a currency that won’t rapidly devalue by month-end.

Thus, in this era, Bitcoin is primarily viewed as an investment. Believers are more likely to use it for payments. Those with specific payment problems (capital controls, platform bans, etc.) are also more inclined to use it, though increasingly they opt for similarly liquid stablecoins. For short-term usage, the centralized nature of stablecoins isn’t a concern.

Early Bitcoin advocates tried to convince holders to spend more Bitcoin. I don’t believe this is sustainable. Bitcoin won’t go mainstream through charity. To achieve sustained mass adoption, it must solve existing market gaps in payments for both spenders and recipients. In the current adoption phase, this is difficult—especially given capital gains taxes on every transaction, and the availability of stablecoins for short-term spending needs.

Having a sound, liquid, fungible, portable store of value gives holders advantages other assets can’t provide during this adoption phase. They can take Bitcoin anywhere in the world without relying on central counterparties or credit systems. It allows holders to avoid substantial capital erosion through cross-border payments (including to recipients banned from platforms). They may not be able to pay with Bitcoin everywhere, but in most cases, they can find ways to exchange it for local currency, and sometimes use it directly.

Imagine you’re randomly going to a country. What currency can you bring to ensure sufficient purchasing power without relying on the global credit network? In other words, even if all your credit cards are deactivated, how can you ensure you can still transact, even with some capital erosion?

The best current answer is usually physical U.S. dollars. If you carry USD, although you may not use it directly, it’s easy to find someone willing to exchange it for local currency at a reasonable rate with good liquidity.

Other answers include gold, silver, and euros. Again, in most countries, it’s not hard to find brokers willing to accept these and exchange them at fair local value.

RMB, yen, pounds, and some other currencies may serve as alternatives but often involve greater capital erosion. I’d place Bitcoin somewhere in the top ten, perhaps between fifth and tenth, especially if you’re heading to a city center. Most cities have numerous exchange options where you can seek help when needed. Considering Bitcoin’s 16-year history, this is remarkable.

The remaining 160+ fiat currencies are very poor outside their home countries—most of them.

The U.S. dollar is currently the most liquid currency globally. Smaller, less liquid assets are almost always priced in larger, more liquid ones. People use larger, more liquid currencies as units of account and denominate their primary liabilities in them.

Previously, the U.S. dollar was defined in terms of a certain amount of gold. Eventually, the dollar network grew larger and more ubiquitous than gold, reversing the situation: today, gold is primarily priced in dollars. In the long arc of history, Bitcoin may surpass the dollar in this way, but it’s far from that level now. What Bitcoin is priced in during its journey doesn’t matter; as a bearer asset, it can be priced in the largest, most liquid currency, and if one day it becomes the largest and most liquid, others will naturally price in it.

While people are free to mentally price things in any currency, most quickly default to pricing in Bitcoin. Critics describe this as a flaw of Bitcoin; however, a new decentralized monetary asset in growth mode has no alternative path besides being priced against existing currencies.

Part Two: How Do Corporations and Bitcoin Stocks Fit Together?

Back in 2014, Pierre Rochard wrote a prescient article titled “Speculative Attack.”

In foreign exchange markets, a speculative attack refers to borrowing weak currencies to buy stronger ones or other high-quality assets. This is one reason central banks raise interest rates, and some countries resort to full capital controls—to prevent entities from arbitraging their mismanaged currencies.

Wikipedia offers an effective definition:

“In economics, a speculative attack is when previously inactive speculators suddenly dump an unreliable asset and acquire a valuable one (currency, gold).”

Due to Bitcoin’s appreciation potential, various entities eventually borrow money to buy more Bitcoin. At the time, Bitcoin was slightly above $600, with a market cap slightly above $8 billion.

Initially, borrowing to buy Bitcoin was rare. Now, the Bitcoin network is highly liquid, with a market cap over $2 trillion, and billions of dollars in corporate bonds from mainstream capital markets are dedicated to buying Bitcoin.

Eleven years later, this phenomenon is commonplace. Is it good or bad for the Bitcoin network?

From my observation, there are two main types of critics who believe it harms the Bitcoin network.

The first group consists of Bitcoin users themselves. Many belong to the crypto-punk or sovereignty camp. From their view, entrusting Bitcoin to custodians seems dangerous—or at least contrary to the ethos of a decentralized network. Some refer to corporate Bitcoin treasury supporters as “suit Bitcoiners,” which I think is a great term. This camp prefers individuals to self-custody their private keys. Some further argue that re-mortgaging by major custodians might suppress price or otherwise damage Bitcoin’s value as a free currency. While I appreciate this camp’s values, some seem to harbor utopian dreams, expecting everyone to care about full control over their money as much as they do.

The second group usually includes those who were previously bearish on Bitcoin. Over the years, they questioned Bitcoin. As Bitcoin became the top-performing asset, repeatedly hitting new highs across multiple cycles, some changed their stance, arguing instead that “Bitcoin’s price may be rising, but its value has already been captured.” I take this camp less seriously than the first. It’s similar to permanent bears in the stock market who, after a decade of failed bearish predictions, shift to saying, “The market rose only because the Fed printed too much money.” My response: “Well, yes—that’s exactly why you shouldn’t be bearish.”

My message to both camps is: Large capital choosing to hold Bitcoin doesn’t mean “libertarian” Bitcoin is damaged in any way. It can still be self-custodied and transferred peer-to-peer as before. Moreover, as more types of entities hold it, the network grows larger and less volatile, enhancing its usefulness as a peer-to-peer payment currency. It may also provide political cover, helping policymakers mainstream it. If Bitcoin reaches this scale, the emergence of Bitcoin stocks and large capital buying Bitcoin is inevitable.

One skill of permanent bears is adjusting narratives on demand so they’re always right regardless of outcome. Bitcoin is defined by them as having no plausible path to success. If Bitcoin stays niche? Then its price growth and circulation are impaired—see, it failed! If it’s adopted by large entities and governments and keeps growing? Then its value has been captured and lost its way.

But if it’s to become large, widely accepted, and transformative—how could that path possibly bypass corporations and governments?

Bitcoin’s price momentum has gone through several major phases.

In the first phase, people mined Bitcoin on their computers or sent money to Mt Gox to buy it—early adopter behaviors involving personal cost. This was the early user phase.

In the second phase, especially after Mt Gox collapsed, buying and using Bitcoin became easier. Domestic exchanges in many countries made purchasing Bitcoin more accessible. In 2014, the first hardware wallets emerged, making self-custody safer. This was the retail buyer phase, with slippage still present but decreasing.

In the third phase, Bitcoin became sufficiently widespread, liquid, and historically established to attract more institutions. Entities built institutional-grade custody solutions, public companies began buying Bitcoin, and various ETFs and financial products emerged, enabling funds and managed capital to gain exposure. Some countries, like Bhutan, El Salvador, and the UAE, began mining or buying and holding Bitcoin at the sovereign level. Others, like the U.S., chose to hold seized Bitcoin rather than selling it outright.

Luckily, even though enterprises are now major buyers, retail investors can still buy Bitcoin freely with zero friction.

I’ve heard people say: “I thought Bitcoin was for the people, peer-to-peer cash—but now it’s all big corporations holding it.” Bitcoin *is* for the people—anyone with internet access can buy, hold, or transfer it.

That’s why I agree with both the crypto-punks and the suit Bitcoiners. I want Bitcoin to work as a free currency—that’s a key reason I became a general partner at Ego Death Capital. We fund startups building solutions for the Bitcoin network and its users. It’s also why I support the Human Rights Foundation and other nonprofits funding developers and educators focused on providing financial tools for people in inflationary environments. Yet once corporations, investment funds, and even sovereign entities understand Bitcoin, it’s reasonable for them to buy it—Bitcoin has now entered their field of vision.

It’s important to remember most people aren’t active investors. They don’t buy stocks or deeply analyze differences between Bitcoin and other cryptos. If they speculate on an asset, they likely buy at the top and get shaken out at the bottom. Their investments are usually passively allocated, not self-directed—often through pension funds in the past, and now typically via financial advisors.

To me, expecting billions of people to actively buy Bitcoin is unrealistic. However, it’s reasonable to work on lowering barriers through technical solutions and education so anyone can choose to engage with Bitcoin.

The best formulation I’ve seen is: “Bitcoin is for anyone, not for everyone.” In practice, this means everyone should be exposed to learning about Bitcoin, but only some will choose to embrace it.

Summary Points

Bitcoin’s monetization unfolds roughly as follows:

Bitcoin begins as a collectible for enthusiasts and idealists—a new technology that might offer people some value.

Bitcoin starts becoming a contextual medium of exchange, even used by pragmatic people who weren’t initially interested. For example, when sending money to a country with capital controls, Bitcoin can transfer value when other payment channels fail. When receiving payments or donations while banned from major online platforms (like WikiLeaks), Bitcoin serves as an effective solution.

High volatility, countless competitors, and capital gains taxes—all forms of purchase friction—hinder Bitcoin’s sustained growth as a common medium of exchange. If you pay a merchant with Bitcoin who doesn’t hold it and automatically converts it to fiat, Bitcoin’s benefits aren’t fully realized.

Bitcoin is more broadly seen as an ideal portable appreciating capital. Unlike other cryptocurrencies, it achieves decentralization, security, simplicity, scarcity, and scale—making it worth holding long-term. While buying coffee with it isn’t always convenient, it’s already entering the top ten bearer assets that can be carried internationally and exchanged for local value without hassle, surpassing most fiat currencies.

The Bitcoin network reaches sufficient liquidity, scale, and durability to attract active attention from corporations and governments. Vast pools of managed capital are interested in the asset, and companies/funds provide indirect access. Meanwhile, Bitcoin continues as an open, permissionless network—meaning individuals also continue to use and build on it.

If the Bitcoin network keeps expanding, it may achieve:

As the Bitcoin network grows larger, more liquid, and less volatile, it becomes more attractive to large sovereign entities. Initially, Bitcoin may be an asset held by small sovereign funds, but eventually evolve into a major foreign exchange reserve or international settlement tool. Countries have tried building closed-source alternative payment systems, but with low adoption and lack of consensus, while this open-source settlement network with an independent unit and limited supply is gradually permeating globally.

Overall, I still believe Bitcoin is in good shape technologically and economically, and its adoption path is expanding as expected.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News