Can Aptos Become the Next Popular Public Blockchain?

TechFlow Selected TechFlow Selected

Can Aptos Become the Next Popular Public Blockchain?

Aptos has demonstrated tremendous growth potential and seems to be on the verge of a breakout.

Author: Icefrog

In the public blockchain space, competition among chains has become increasingly fierce. As everyone knows, user adoption is key to dominance. Ethereum (ETH), a well-established chain, holds an absolute advantage but its high gas fees deter many users. Solana, with its low costs and faster speeds, has become a more favored option. Fueled by the meme trend, Solana has seen explosive growth in user numbers.

This year, TON and SUI have each experienced significant technological breakthroughs. In contrast, Aptos appears to have remained relatively under the radar—has it truly failed to gain momentum, or is it quietly building strength?

This article will analyze Aptos' performance against other public blockchains using metrics such as TVL, daily active users, daily transaction volume, and meme activity, while also assessing its potential for breakout growth.

1. Current Competitive Landscape Among Public Blockchains

1. TVL Data Comparison:

-

In terms of overall TVL, Solana leads by a wide margin, significantly ahead of other chains chasing Ethereum, with total TVL about 4–5 times higher than its peers. This advantage stems from its early launch, allowing it to secure a strong competitive position.

-

Over the past year, Solana's growth rate was approximately 1596.79%, Sui’s around 2037.15%, Aptos’ about 2951.21%, and TON’s reached 3934.39%.

-

TON recorded the highest growth at 3934.39%, meaning its TVL increased nearly 40-fold within a year. This surge was driven by major token launches on TON such as NOTCOIN in May, DOGS in August, and CATI, RBTC, and HMSTR in September—all distributed via airdrops to Telegram mini-app users. Within a week of the first airdrop, all tokens had over 1 million holders. Leveraging these mini-apps, TON rapidly attracted a massive user base. Aptos ranked second in growth at 2951.21%, reaching new historical highs.

2. User Growth Data Comparison:

-

As shown in the chart, daily active users across all chains have grown over the past year.

-

Aptos saw a growth rate of approximately 672.23%. Ethereum experienced a slight decline of about -27.14% over the same period. Solana grew by approximately 743.46%, while TON achieved a remarkable 2483.45% increase.

-

Sui recorded the highest user growth rate, with daily active users rising from 19,758 on January 1, 2024, to 656,249 on October 8, 2024—an increase of 3221.43%, the largest among all competing L1 chains.

3. Comprehensive Analysis of Aptos Performance:

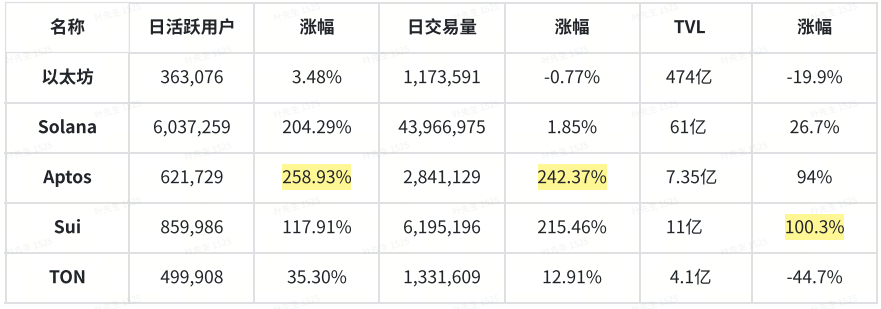

Note: The table shows gains over the most recent three months

Performance Over the Past Year

-

Keeping pace with competitors, holding strong ground: In a highly competitive public blockchain environment, Aptos has demonstrated strong competitiveness. It has kept up with rivals without falling behind, showing no clear disadvantages across key metrics. This indicates solid capabilities in technology, ecosystem development, or market strategy.

-

Daily active user gap compared to Solana: Solana is a relatively mature blockchain that has accumulated a substantial user base over time. As a newer entrant, Aptos naturally lags behind Solana in total daily active users, which is understandable given the difference in maturity.

Performance Over the Last Three Months

-

Outperforming and leading: In the past three months, Aptos has led in growth of daily active users and daily transaction volume. Its robust DeFi ecosystem has drawn in more users and trading activity, while significant capital inflows further demonstrate market recognition. Investors likely see Aptos' growth potential and trajectory as promising, leading them to allocate funds accordingly.

-

Potential gaining market recognition: Market recognition of a project typically manifests through price appreciation, user growth, and rising transaction volumes. Aptos’ performance over the last three months aligns with these indicators, suggesting its potential is being increasingly acknowledged. There is solid evidence pointing to strong future prospects. If Aptos can sustain its current momentum, continue innovating, and expand its user base and ecosystem, it stands a good chance of achieving even greater success in the future.

2. The Importance of Memes in the Ecosystem

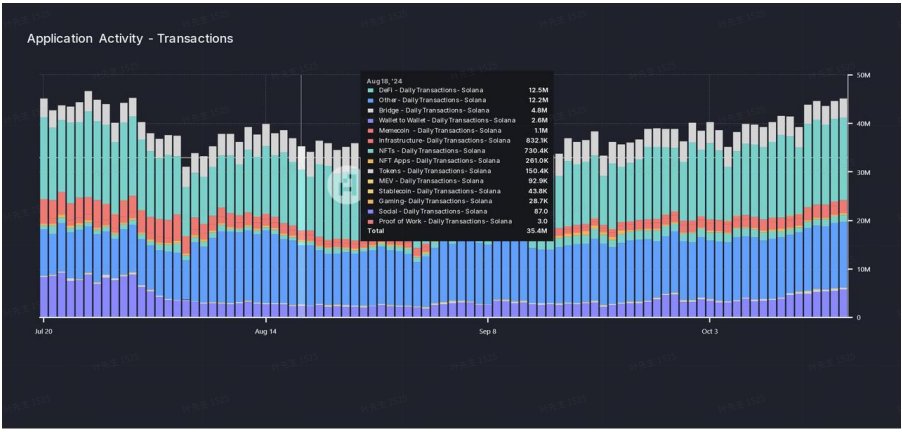

1. Meme Activity in the Solana Ecosystem:

-

According to the charts above, memes are playing an increasingly influential role in Solana. Approximately 40% of Solana’s trading volume comes from meme tokens, with pump.fun alone accounting for 35% of Solana’s DEX trading volume. Solana currently dominates on-chain trading volume and has surpassed Ethereum in short-term transaction volume.

-

Solana: $51 billion | Ethereum: $46 billion

-

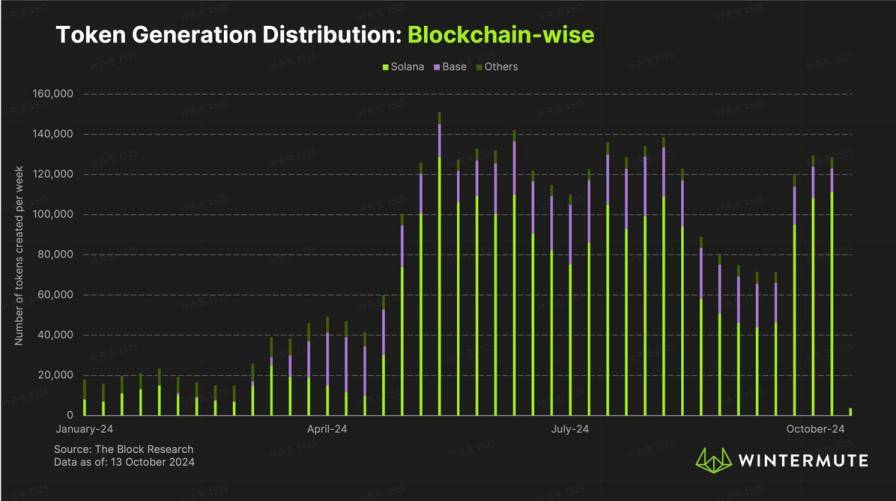

Solana now also dominates token creation: Its market share rose from 60% at the beginning of September to 86%, with weekly token generation surging from 45,000 to 110,000.

2. Meme Activity in the SUI Ecosystem:

-

On-chain data analysis shows that meme tokens play a crucial role in the SUI ecosystem as well, contributing to nearly 50% of total trading volume. At market peaks, meme trading volume accounted for up to 90% of the entire ecosystem. The surge in meme tokens has driven broader ecosystem momentum.

-

Compared to total TVL, trading volume more directly reflects DeFi participant engagement and is a key indicator of ecosystem health. Active on-chain trading not only generates higher returns for liquidity providers but also demonstrates the network’s self-sustaining revenue capability through elevated transaction fees.

-

In this cycle, the SUI blockchain has stood out due to its superior performance and broad community support, reigniting interest in the Move language and attracting numerous developers and users. As a flagship Move-based chain, SUI is widely seen as a potential next-generation leader among public blockchains and the top choice for Move ecosystem development.

3. Meme Activity in the APT Ecosystem:

With the rise of the SUI ecosystem, Aptos—its fellow Move-language twin—naturally draws increasing attention.

-

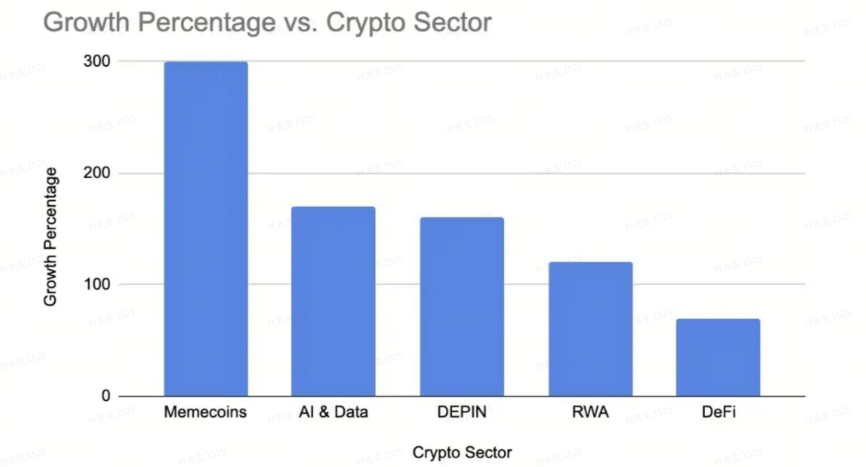

Market data shows that in 2024, meme coins outperformed all other cryptocurrency sectors, with no signs of slowing down since.

-

The wealth-generation effect of memes has increasingly captured institutional interest in meme tokens, potentially signaling a shift in overall market perception. According to CoinGecko, the total market cap of the meme coin sector is currently around $58 billion, representing just 2.4639% of the crypto industry’s total market cap of $2.354 trillion—less than 2.5%. This suggests the meme coin sector still has enormous room for growth and upside potential.

-

From early Solana to today’s SUI, the power of memes has been proven undeniable. Aptos and SUI share extremely similar backgrounds—their core teams both originated from Meta’s (formerly Facebook) Diem cryptocurrency project and Novi digital wallet. Seeing their "older brother" ride the meme wave successfully, Aptos is highly likely to follow suit, leveraging this momentum to make a strong push in the meme space.

3. Aptos’ Potential Advantages

1. Technical Architecture and Performance:

-

High Performance and Scalability: Aptos employs the "Block-STM" consensus algorithm, combining parallel processing with transactional memory technology, enabling thousands of transactions per second. This significantly enhances blockchain throughput and scalability, making it highly efficient for handling large-scale transactions and meeting growing demands for blockchain applications. Compared to lower-performance chains, Aptos offers users a faster and smoother experience.

-

Advanced State Synchronization Technology: Full nodes can achieve state synchronization by reading Merkle tree roots already agreed upon by other nodes, allowing them to skip historical data and process only the latest blocks. Light nodes can choose to synchronize partial block information, such as specific account states. This reduces node workload, improves network synchronization efficiency, and enables nodes to participate more quickly in validation and transaction processing.

2. Security:

-

Wide Node Distribution: Nodes span 22 countries and 48 cities. For an attacker to compromise the Aptos network, they would need to simultaneously attack multiple geographically dispersed nodes, greatly increasing the difficulty and cost of any attack. Compared to chains with concentrated node locations, Aptos offers stronger resistance to malicious attacks, ensuring greater network stability and security.

-

Secure Move Programming Language: The Move programming language was originally developed for Meta’s stablecoin project and features high security. Assets are stored in user-owned addresses rather than contract addresses, and every transaction outcome is fully predictable, significantly reducing smart contract risks. Compared to high-level smart contract languages used by other chains (such as Ethereum’s Solidity), Move offers stronger security guarantees, minimizing vulnerabilities and attack vectors.

Conclusion

-

Basing on the above analysis, the following conclusions can be drawn: Aptos has demonstrated significant growth potential and shows signs of an impending breakout. Although its current TVL and total daily active users remain below some leading industry projects, its strong performance over the past three months—particularly in daily active users, daily transaction volume, and capital inflows—suggests considerable promise for future development.

-

Of course, Aptos faces multiple challenges. Regarding decentralization, Aptos prioritizes high performance when addressing the blockchain “impossible trinity,” which somewhat compromises node decentralization. From a technological innovation standpoint, Aptos has primarily focused on enhancing chain performance and has yet to introduce more disruptive new technologies. Additionally, in ecosystem development, Aptos lacks standout native projects. Many of its current projects originate from other ecosystems, potentially leading to multi-chain deployments and severe homogenization, lacking unique innovations.

-

The public blockchain market is fiercely competitive, with established players like ETH and Solana maintaining strong positions through their respective advantages, while emerging challengers like Sui and TON add further pressure. In such an environment, standing out is no easy feat for Aptos.

-

If Aptos can overcome these challenges, effectively harness emerging forces like memes, continuously innovate and refine its technology, and expand its ecosystem, it still has a real chance of securing a prominent place in the competitive public blockchain landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News